Ethereum (ETH): Unleashing the Potential of Decentralized Computing and Smart Contracts

Introduction:

Ethereum

(ETH) stands tall as one of the most influential cryptocurrencies, offering far

more than just a digital currency. In this comprehensive guide, we will delve

into the intricacies of Ethereum, exploring its origins, technology, use cases,

and potential impact on the future of finance and decentralized applications.

1.

The Birth of Ethereum:

1.1

The Vision of Ethereum

- Discuss the background and motivation

behind Ethereum's creation by Vitalik Buterin and the Ethereum Foundation.

- Highlight the key principles driving

Ethereum's development, such as decentralization, transparency, and

empowerment.

1.2

Ethereum vs. Bitcoin: Contrasting Approaches

- Compare and contrast Ethereum with

Bitcoin, emphasizing Ethereum's focus on programmable smart contracts and

decentralized applications (DApps).

- Explore how Ethereum expanded the

potential of blockchain technology beyond digital currencies.

1.3

The Ethereum Virtual Machine (EVM)

- Explain the concept of the Ethereum

Virtual Machine (EVM) as a Turing-complete runtime environment that executes

smart contracts.

- Discuss the significance of the EVM in

enabling developers to build a wide range of decentralized applications.

1.4

The Ethereum Community

- Highlight the vibrant Ethereum community,

including developers, contributors, and enthusiasts.

- Discuss the role of the Ethereum

Foundation in supporting the ecosystem and fostering innovation.

2.

Understanding Smart Contracts:

2.1

Introduction to Smart Contracts

- Define smart contracts and their role in

automating and enforcing agreements on the Ethereum blockchain.

- Discuss the benefits of smart contracts,

such as efficiency, transparency, and elimination of intermediaries.

2.2

Programming Languages for Smart Contracts

- Explore the programming languages used to

develop smart contracts on Ethereum, including Solidity, Vyper, and others.

- Provide an overview of the development

tools and frameworks available for smart contract development.

2.3

Use Cases of Smart Contracts

- Highlight various real-world use cases of

smart contracts, such as decentralized finance (DeFi), supply chain management,

identity verification, and decentralized governance.

- Discuss specific examples and success

stories in each use case category.

2.4

Smart Contract Security

- Address the importance of smart contract

security and the potential risks associated with coding vulnerabilities.

- Explain the role of code audits, formal

verification, and best practices in ensuring the security of smart contracts.

3.

Ethereum 2.0 and Proof of Stake:

3.1

The Need for Ethereum 2.0

- Discuss the scaling challenges faced by

Ethereum, including network congestion and high fees.

- Explain the goals of Ethereum 2.0 in

addressing these challenges and improving scalability.

3.2

Transitioning to Proof of Stake (PoS)

- Explain the transition from Ethereum's

current proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS) in

Ethereum 2.0.

- Discuss the benefits of PoS, such as

increased scalability, energy efficiency, and network security.

3.3

Beacon Chain and Shard Chains

- Introduce the concept of the Beacon Chain

as the backbone of Ethereum 2.0, responsible for coordinating validators and

maintaining consensus.

- Explain the role of shard chains in

parallelizing transactions and improving network capacity.

3.4

Staking on Ethereum 2.0

- Discuss the process of staking and

becoming a validator on Ethereum 2.0.

- Highlight the potential rewards and

incentives for participants in the staking ecosystem.

3.5

The Roadmap and Challenges Ahead

- Outline the development roadmap

for Ethereum 2.0 and the anticipated

milestones.

- Address potential challenges and risks

associated with the Ethereum 2.0 upgrade.

4.

Decentralized Finance (DeFi) on Ethereum:

4.1

Introduction to DeFi

- Define decentralized finance (DeFi) and

its transformative potential in reshaping traditional financial systems.

- Explain the key principles of DeFi, such

as open access, permissionless innovation, and financial inclusivity.

4.2

Decentralized Exchanges (DEXs)

- Explore the rise of decentralized

exchanges as alternatives to traditional centralized exchanges.

- Discuss popular DEXs built on Ethereum,

their features, and their impact on liquidity provision and trading.

4.3

Lending and Borrowing Protocols

- Explain the emergence of decentralized

lending and borrowing platforms, enabling peer-to-peer lending without

intermediaries.

- Discuss the benefits and risks associated

with DeFi lending protocols.

4.4

Yield Farming and Liquidity Mining

- Explore the concept of yield farming and

liquidity mining as mechanisms for earning rewards and incentives in DeFi.

- Discuss the risks and considerations

involved in participating in yield farming strategies.

4.5

Stablecoins and Synthetic Assets

- Discuss the role of stablecoins in DeFi,

their pegging mechanisms, and their use in lending, trading, and remittances.

- Explore the concept of synthetic assets

and their potential to provide exposure to real-world assets on the Ethereum

blockchain.

4.6

Challenges and Regulation in DeFi

- Address the challenges and risks

associated with DeFi, including smart contract vulnerabilities, security

incidents, and regulatory concerns.

- Discuss the evolving regulatory landscape

and the potential impact on DeFi platforms and users.

5.

Ethereum's Impact on Industries and Beyond:

5.1

Decentralized Applications (DApps)

- Highlight notable decentralized

applications built on Ethereum and their impact on various industries.

- Discuss DApps in areas such as gaming,

decentralized social media, supply chain management, and governance.

5.2

Interoperability and Cross-Chain Compatibility

- Discuss the importance of interoperability

in blockchain ecosystems and the efforts to achieve seamless communication

between different blockchains.

- Explore Ethereum's role in facilitating

interoperability through projects like Polkadot, Cosmos, and interoperability

protocols.

5.3

Tokenization and Digital Assets

- Explain the concept of tokenization and

its potential to transform the way we represent and trade real-world assets.

- Discuss token standards on Ethereum, such

as ERC-20, ERC-721, and ERC-1155, and their role in enabling asset

digitization.

5.4

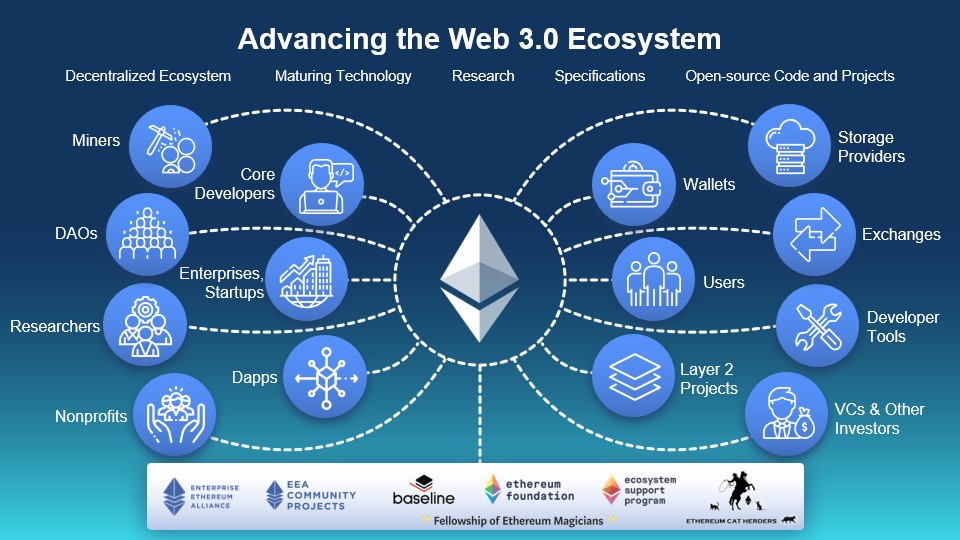

Ethereum and Web 3.0

-

Discuss the vision of Web 3.0, where decentralized applications and user-owned

data are at the core.

- Explain Ethereum's role as the

foundational platform for building Web 3.0 applications and enabling user

sovereignty.

Conclusion:

Ethereum

has emerged as a trailblazer, empowering developers and users with its robust

platform for decentralized applications and smart contracts. As Ethereum

continues to evolve, it holds the promise of transforming multiple industries

and fostering a new era of trust, transparency, and financial inclusivity. With

Ethereum 2.0 on the horizon, the scalability and efficiency of the network are

set to improve further, unlocking even greater potential. As we witness the

maturation of Ethereum and the continued growth of the Ethereum ecosystem, it

becomes increasingly clear that Ethereum is not just a cryptocurrency but a

groundbreaking technology with the power to shape the future of finance and

decentralized computing.

Comments

Post a Comment